As a business owner, it’s important to maintain your cash flow and it can be difficult when you feel like your finances are pulled in a million different directions. There are incentives out there to help you but they are often misunderstood. Two of the most significant incentives available to companies in Canada are IRAP and SR&ED. IRAP (Industrial Research Assistance Program) is a discretionary grant program available through the National Research Council (NRC). Companies can work with an NRC advisor to apply for funding; the decision to fund is ultimately at the discretion of the advisor. SR&ED (Scientific Research and Experimental Development) is a tax credit founded in income tax legislation; if you feel you meet the criteria, you submit a claim as part of your corporate tax compliance activities. Did you know that they can go together to get you the maximum return on your investment?

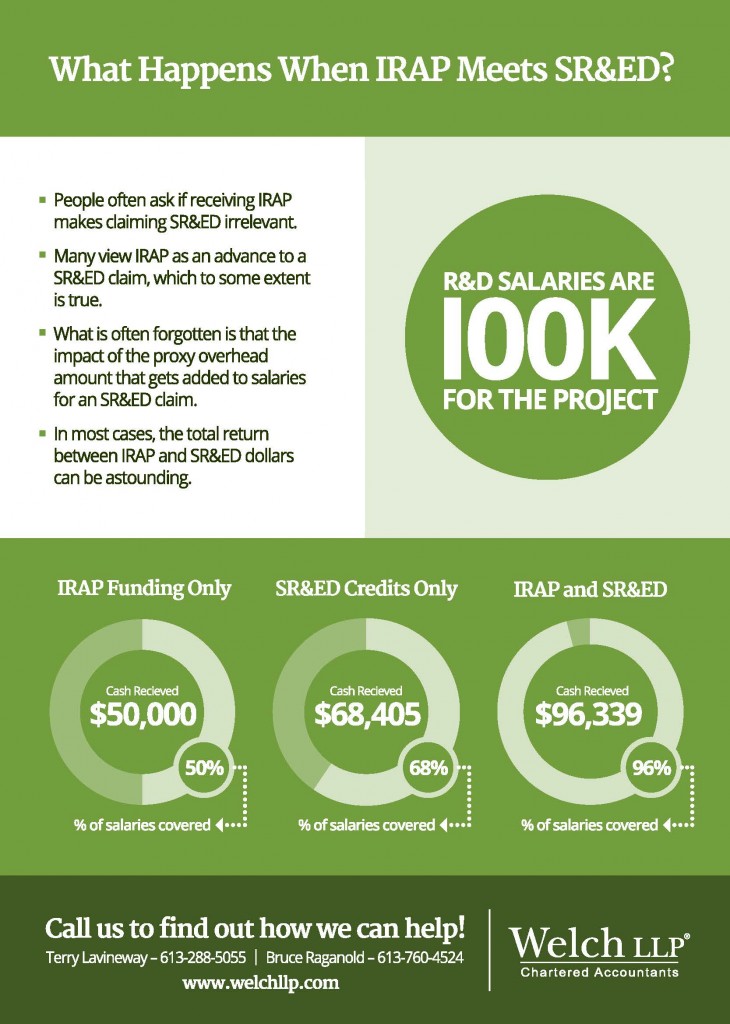

The perception exists that any company that receives IRAP funding should not bother claiming SR&ED because the IRAP funding received offsets any SR&ED claim on that project. While it is true that IRAP funding received typically reduces your SR&ED claim (with some exceptions), there is still a strong financial reason to file an SR&ED claim.

As the infographic shows, $100,000 in salary can result in over $96,000 of government funding through IRAP and SR&ED!! Unbelievable, right? Maybe you are thinking, “That can’t be correct!”

Well, follow this math:

$100,000 R&D spend

IRAP reimburses $50,000.

SR&ED claim is $100,000 + $55,000 (proxy overhead) – $50,000 (IRAP assistance) = $105,000 @ 44.1% combined tax credit rate for SR&ED in Ontario

The total amount you could receive back is $50,000 from IRAP) + $42,086 from SR&ED for a grand total of $92,086! Once you add in $4,253 of non-refundable tax credits to this, you will get $96,339 of total funding.

There are no guarantees that this amount will work out for each claim but you have nothing to lose by claiming both and as the numbers show, you actually have a lot to gain!

IRAP and SRED infographic – no salary for owners

Where you have the opportunity for an IRAP grant, do not forego your SR&ED claim. If you need some advice or you aren’t sure where to start in the IRAP or SR&ED process, please feel free to contact Joshua Smith at jsmith@welchllp.com.

Joshua Smith

Business Incentives Leader