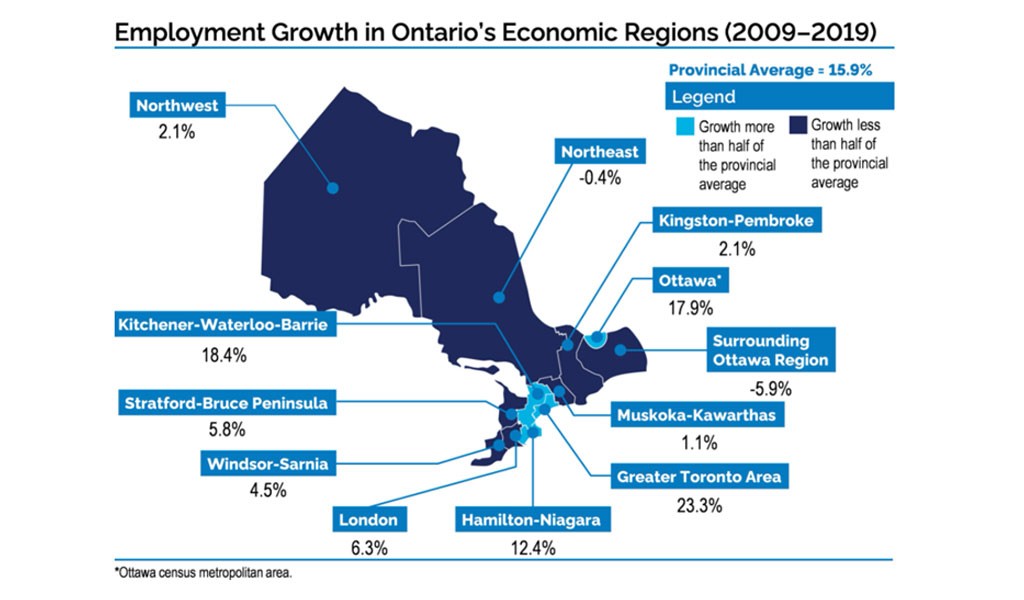

Between 2009 and 2019, there were 34 regions in Ontario that lagged in employment growth. These regions experienced growth less than half of the provincial average of 15.9%. In some cases, there was a negative growth, such as in the surrounding Ottawa region with a rate of -5.9%. The provincial government has introduced The Regional Opportunities Investment Tax Credit (ROITC) to help these regions.

The Regional Opportunities Investment Tax Credit (ROITC) was created to help support business investment, economic growth and job creation in regions in Ontario that lagged in employment growth between 2009 and 2019. The credit is available to Canadian-controlled private corporations that have a permanent establishment in Ontario that make an investment in a designated region. It is a 10% refundable tax credit for corporations that invest between $50,000 and $500,000 on a qualifying expenditure, up to a maximum credit of $45,000. There is currently a temporary enhancement of the credit that provides an additional 10% (for a total of 20%) for eligible purchases that are available for use beginning March 24, 2021 and ending January 1, 2023. This enhancement increases the maximum credit available to $90,000.

For the investment to be considered eligible, the amount must be used to acquire, renovate or make additions to a qualifying property, and become available for use on or after March 25, 2020. In addition, the eligible property must be a commercial or industrial building that is included in Class 1 or 6 for Capital Cost Allowance (CCA) purposes.

For more information and to see a list of the designated regions, please see this bulletin.

Author:

Destiny Hansma

Staff Accountant

[email protected]