What does NFT mean?

Non-fungible token.

What does “non-fungible” mean?

An item that has unique characteristics that cannot be traded for another item having the exact same characteristics. On the other hand, something fungible such as a gold bar or a dollar would have properties that are indistinguishable from another item of the same nature.

What’s an NFT and why are we talking about it?

An NFT today represents proof of ownership for the single holder of a unique item and is secured on the blockchain, and the concept has gained significant interest in the past couple of years. The majority of NFT’s are on the Ethereum (ETH) blockchain, but others are starting to gain traction, such as Solana (SOL).

At the time of writing this, NFT’s have revolutionized the digital art world and have provided artists a platform to sell their pieces. The sale of a unique digital artwork is not the only practical use of NFT’s, but it’s the most popular use as of now. Other uses include the ownership of a high-end fashion item, a domain name, or any collectible item.

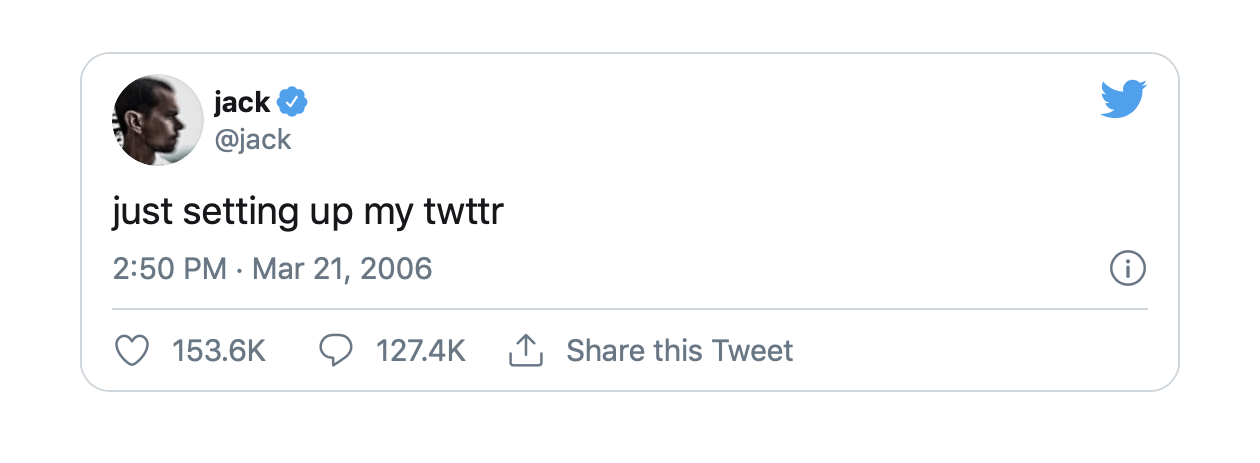

The subject of NFT’s recently gained media attention when the founder of Twitter sold his first tweet as an NFT for just under $3 million USD, and a digital artist known as Beeple sold an NFT at Christie’s auction house for $69 million USD. So as you can see, artists see this as an opportunity to put their name on the map and make money, and buyers and investors see this as a very lucrative investment strategy. But one topic both parties need to consider is the tax implication on the sale of NFT’s.

Tax on Sale NFT’s

There has not been any discussion from CRA on how one would be taxed on the sale of an NFT. However, it is likely that the tax implications of a sale of an NFT would depend on the nature of the transaction.

If you initially purchased the NFT as a form of a long-term investment, or you purchased the piece because you truly believe in the artist’s work, the NFT might be considered a capital asset and the sale would result in a capital disposition. Each transaction requires the payment of “gas fees” from the buyer (gas refers to the computational effort required to execute a specific operation on the Ethereum network); they are essentially transaction fees, and would be included in the tax cost of your NFT. Half of the gain would be taxable for the seller (however, there have been rumours about the capital gain inclusion rate possibly increasing; more on this discussed here).

If you purchased NFT’s in order to make a profit in the short term (flipping), deal in trading NFT’s to earn cryptos, or you are the artist that created the NFT, then the NFT’s would likely be considered inventory and the income would be characterized as business income, meaning the entire profit would be taxable.

In either situation, the proceeds would be equal to the Canadian dollar equivalent of the ETH received at the time of the sale.

If you’re the artist minting the NFT’s, then you can potentially be earning royalties in the form of a percentage of all subsequent sales of your piece on the secondary market. If the corporation is in the business of minting and selling NFT’s, the royalties received could be considered active business income, since the taxpayer’s principal business purpose is to engage in creating and selling NFT’s.

Other considerations

If you’ve carried on significant activity with NFT’s (whether trading, earning royalties, etc.), you may have accumulated NFT’s and cryptos with a tax cost over $100,000. This could result in foreign asset information reporting obligations (Form T1135) in each tax year you hold NFT’s with a cost of at least $100,000.

There are also GST/HST implications. The initial sale by you and the royalties you receive (if you’re the artist) from the resale of the NFT can be considered a taxable supply for GST/HST purposes. If the purchaser can confirm that they are a non-resident of Canada for tax purposes, the revenue received would be considered zero-rated. However, given that buyers are able to remain anonymous, it would be difficult to ever confirm that, so it would deem the revenues received to be inclusive of 15% HST, the highest HST rate in Canada.

With this environment being relatively new and very unregulated, now would be the best time to contact your Welch advisor to ensure you are tax compliant, if you’ve already dived head-first into the metaverse.

Author

Edwin Ma

Manager

ema@welchllp.com