Use of Investment Hold co Part 2

- Published

- January 1, 2026

- Topic

- Tax Memo

This memo provides an overview of the tax treatment of investment income earned by a Canadian holding company (“Holdco”), with a focus on the passive income rules under the Income Tax Act (“the Act”). The analysis addresses how these rules affect the corporate tax rate on investment income, the operation of the refundable dividend tax on hand (“RDTOH”) regime and the potential impact on the availability of the small business deduction (“SBD”) for active business corporations.

Key Concepts

A Canadian holding company is typically structured as a Canadian-controlled private corporation (“CCPC”). A CCPC is subject to Canadian tax on its worldwide income, including all forms of investment income (interest, dividends, rents, royalties, and capital gains), regardless of the source jurisdiction.

Investment income earned by a CCPC is generally taxed at a higher rate than active business income. Tax on investment income has two components, consisting of non-refundable and refundable taxes. The non-refundable tax is payable by the CCPC regardless of whether dividends are distributed to a shareholder. The refundable portion of tax is paid in the year taxable income is earned, however, it may be refunded when the CCPC pays a taxable dividend to a shareholder.

The mechanics of the taxation of investment income earned by a corporation are intended to meet the objective of “integration”, which means that after a Holdco pays tax on investment income and distributes the funds as dividends to its shareholder(s), the total corporate and personal tax payable should be approximately the same as if the individual shareholder(s) had earned the investment income directly.

Taxation of Investment Income

The tax rates and non-refundable/refundable tax breakdown applied to investment income earned in a CCPC depend on the type of investment income. These rates also vary by province. The tax rates applied to different types of investment income earned by a CCPC in Ontario are discussed below:

- Interest, Rent, Royalties

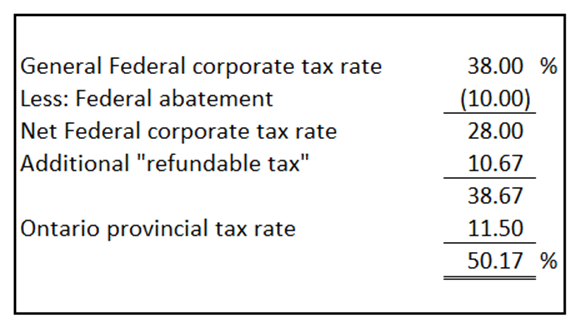

The preliminary tax rate applied to this investment income in Ontario is 50.17% and is calculated as follows

The portion of the above tax which is refundable if the CCPC pays a taxable dividend to the shareholder(s) is 30.67%, which would reduce the effective corporate tax rate to 19.5%, while the individual shareholder(s) would incur personal tax on the dividend received.

- Capital Gains

Capital gains are effectively taxed at 50% of the rate applied to general investment income, as only 50% of a capital gain is taxable. Accordingly, the preliminary tax rate applied to capital gains is 25.08%, including the refundable portion of 15.33%.

Capital gains earned in a CCPC also result in an increase to a notional account known as the Capital Dividend Account (“CDA”) which is equal to the 50% non-taxable portion of the capital gain. Therefore, capital gains distributed to a shareholder can result in two types of dividends: a taxable dividend, as well as a “capital dividend” paid from the CDA which can be received tax-free by the shareholder. The CDA mechanism is another tool of the tax system to achieve integration such that capital gains earned by a corporation are taxed in the same way as if they were earned personally by an individual.

- Canadian Dividend Income

Canadian dividend income is taxed in a unique manner under a different part of the Act, depending on whether it is “eligible” dividend income or “ineligible” dividend income. Eligible dividend income consists generally of dividends from corporate income that has not been taxed at the SBD rate, including dividends received from Canadian publicly traded corporations.

The corporate tax rate for both eligible and ineligible dividends is 38.33%. This corporate tax is fully refundable where dividends are paid to a shareholder.

Refundable Dividend Tax on Hand and Dividend Refunds

As discussed, a portion of the tax paid by a CCPC on its investment income is refundable when the

corporation pays taxable dividends to its shareholders. This is tracked through two notional accounts – Eligible Refundable Dividend Tax on Hand (“ERDTOH”) and Non-Eligible Refundable Dividend Tax on Hand (“NERDTOH”).

Generally, for every $100 of taxable dividends paid, the corporation may receive a refund of $38.33, up to the balance in its ERDTOH and/or NERDTOH accounts.

The difference between the ERDTOH and NERDTOH account balances depends on the source of investment income that gave rise to the refundable dividend tax on hand.

The components of ERDTOH for a Holdco generally consist of the corporate tax paid on eligible dividends from portfolio investments received by the corporation. The ERDTOH balance at the end of the previous year (less any dividend refund paid out of ERDTOH in the prior year) is carried forward to subsequent years.

The components of NERDTOH generally consist of the refundable portion of tax paid on all other investment income, including interest, rent, royalties and capital gains. The NERDTOH balance at the end of the previous year (less any dividend refund paid out of NERDTOH in the prior year) is carried forward to subsequent years.

A corporation can receive a refund from its ERDTOH account when it pays either an eligible or ineligible dividend. However, there is an ordering rule that provides that where a non-eligible dividend is paid, the NERDTOH account must be exhausted first before a refund can be claimed from ERDTOH. Conversely, a refund of NERDTOH can only be received from the payment of non-eligible dividends.

This distinction is again intended to ensure proper integration, as eligible dividends are taxed at a lower personal tax rate when received directly by individual shareholder(s).

Practical illustration

The following table illustrates the mechanics of the taxation of investment income earned in a CCPC and assumes a full distribution to a shareholder who is at the highest marginal tax rate in Ontario.

| Other Investment Income | Capital Gains | Ineligible Dividends | Eligible Dividends | |

|---|---|---|---|---|

| Income earned in the corporation | 10,000 | 10,000 | 10,000 | 10,000 |

| Corporate taxes | (5,017) | (2,509) | (3,833) | (3,833) |

| Dividend refund | 3,067 | 1,533 | 3,833 | 3,833 |

| Amount available for distribution | 8,050 | 9,025 | 10,000 | 10,000 |

| Capital dividend to shareholder | (5,000) | |||

| Amount for ineligible dividend | 8,050 | 4,025 | 10,000 | |

| Amount for eligible dividend | 10,000 | |||

| Tax on ineligible/eligible dividend | (3,843) | (1,921) | (4,774) | (3,934) |

| Retained by the shareholder | 4,207 | 7,103 | 5,226 | 6,066 |

| Effective tax rate | 57.93% | 28.97% | 47.74% | 39.34% |

| Highest marginal personal tax rate | 53.53% | 26.76% | 47.74% | 39.34% |

| Cost to earning income in corporation | 4.40% | 2.21% | 0.00% | 0.00% |

| Potential deferral | 3.36% | 1.68% | 9.41% | 1.01% |

Based on the above table, there is generally a cost to earning passive income (other than Canadian dividend income) in a corporation on a “full distribution” basis. However, in all cases, there is a potential deferral of tax where investment income is earned and retained in a corporation, assuming the individual shareholder is at the highest marginal tax rate. However, as discussed in Part I of this memo series, the use of a holding company may provide various benefits that can mitigate this tax cost.

Impact of Passive Investment Income on the SBD

The SBD allows a CCPC to pay a reduced tax rate on its first $500,000 of active business income. However, this active business income limit for a particular year is reduced if the CCPC (or an associated group of corporations) earns more than $50,000 of “adjusted aggregate investment income” (AAII”) in the previous year, in the following manner:

- for every $1 of AAII above $50,000, the business limit is reduced by $5; and

- the SBD is fully eliminated when AAII reaches $150,000.

As a result, high levels of passive investment income earned within a corporate group can significantly increase the tax rate on a CCPC’s active business income by reducing or eliminating access to the SBD.

Definition of Adjusted Aggregate Investment Income (“AAII”)

AAII generally includes the following:

- net taxable capital gains (excluding gains from active business assets);

- interest, rents, royalties, and other income from property; and

- other income from a “specified investment business” (unless the business employs more than five full-time employees).

- taxable dividends not received from a connected corporation (i.e., portfolio dividends);

AAII generally excludes income that is incidental to or pertains to an active business, or from an asset that is used or held principally for the purpose of gaining or producing income from an active business.

Conclusion

The passive income rules in the Act are designed to limit the tax deferral advantages of earning investment income through a private corporation. They do so by imposing higher taxes on passive income, reducing access to the SBD as passive income increases, and restricting the refundability of taxes paid on investment income. These rules require careful planning to avoid unintended tax consequences and to ensure compliance. However, there remain several potential benefits to incorporating a corporation to hold passive assets, including tax deferral as well as additional advantages as outlined in Part I of this memo series.

Please contact your Welch LLP advisor if you require further analysis or wish to discuss planning strategies for your holding company’s investment income.