Fundraising

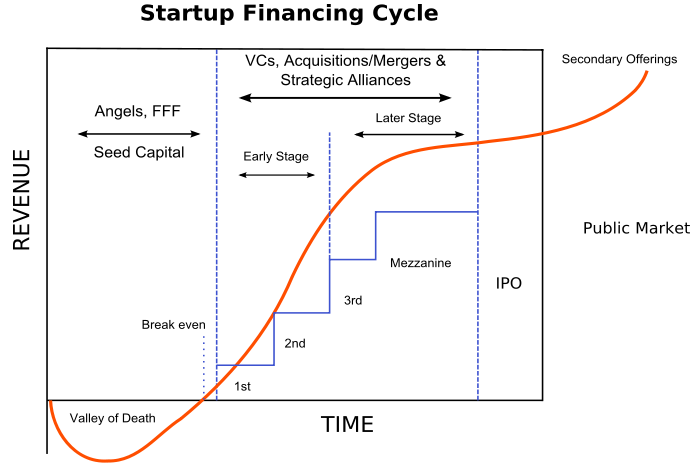

Entrepreneurs who have started and are growing their new business will always have to tackle the funding gap – the gap between the capital needed to cash flow business expenses and the business’s ability to fund those expenses. The longer this funding gap is expected to last, the more important and challenging the task of ensuring the company has sufficient funding becomes. The typical stages of funding typically resemble the following:

Some examples of traditional instruments/contracts used to raise capital include:

[su_row][su_column]

- Government assistance

- Crowd funding

- Common shares

- Preferred shares

[/su_column][su_column]

- Traditional debt

- Convertible debt

- SAFE (Simplified Agreement for Future Equity) or KISS (Keep It Simple Security)

[/su_column][/su_row]

The increasing popularity of cryptocurrencies and Initial Coin Offerings (“ICO”) has added another fundraising option that is garnering significant attention.

ICOs – What are they?

An ICO is a fundraising mechanism in which new projects sell their underlying crypto tokens in exchange for bitcoin, etherium, or some other cryptocurrency. It is similar in some respects to crowd funding campaigns. When using an ICO, the company needs to define the purpose of the token being sold. Is it a utility token that provides the holder with some value or utility that can be used/consumed/exchanged in the future? Or is it a security where the holder of the token benefits from the change in value relative to the company’s value, similar to traditional equity? Security tokens are difficult to issue in North America due to the expectation that they fall within the securities regulations and therefore need to conform to the securities rules and regulations prior to issuance.

The creation of a token for sale is a relatively straight forward process which is in part leading to the rise and use of ICOs to raise capital. Some reports have indicated that close to $US6B of capital was raised in 2017, with the average ICO raising almost $US13M – a number that is bound to get the attention of entrepreneurs.

Using ICOs in the form of an equity token in North America in the short term is likely to be challenging given the need to conform to the securities rules and regulations. A utility token could be an alternative consideration, if, the business model lends itself to use of a token. Care should be taken to not force the business model to conform to a utility token sale as this could create unintended consequences in the future commercialization of the business.

Similarly, the timing of when the ICO occurs should also be thought out. The ICO should consider whether to wait until the business has established its solution and can clearly link the value to a utility token. There are many other considerations that entrepreneurs need to weigh beyond access to capital, including who will own/purchase the token, how to convert the cryptocurrency into fiat currency (USD or CAD), and tax considerations.

Tax considerations – Income and Commodity Tax

The reality of doing business in Canada is to develop an understanding of the tax implications of business transactions. When the crowd funding wave hit, many entrepreneurs designed successful crowd funding campaigns that resulted in raising significant capital on the pre-sale of products or from community support. Unfortunately, many did not factor in taxes when designing their campaigns resulting in an unanticipated impact on the availability of capital. This scenario is recurring for ICOs, with companies designing ICOs without considering tax.

The Canada Revenue Agency (CRA) is behind on the establishment of rules and regulations related to cryptocurrency because they have no specific guidance. We would expect CRA to consider both the income and commodity (GST/HST) tax that would be applicable to the proceeds raised via an ICO. It is important to note that the tax rules are laid out in separate tax acts: the Income Tax Act (ITA) for income taxes, and the Excise Tax Act (ETA) for commodity tax (GST/HST).

Does tax apply to your ICO?

As a start, it is important to know that in 2014, the Bank of Canada released a position paper concluding that bitcoin and other cryptocurrencies fail to meet the definition of money. Likewise, in 2013, a fact sheet released by the Canada Revenue Agency (CRA) stated that bitcoin and other digital currencies were not currency for Canadian tax purposes. Instead, the CRA concluded that a bitcoin was a commodity, like gold or oil. So, the tax rules concerning barter arrangements apply to bitcoin transactions.

Income tax

We expect that CRA, based on the fact sheet issued in 2013, would view the sale of tokens as a barter transaction. CRA issued a tax bulletin in 1982 on barter transactions, defining them as:

A barter transaction is effected when any two persons agree to a reciprocal exchange of goods or services and carry out that exchange usually without using money. In a barter transaction between persons who are dealing with each other at arm’s length, it is a fundamental principle that each of those persons considers that the value of whatever is received is at least equal to the value of whatever is given up in exchange therefor.”

This bulletin concludes that barter transactions are considered income or expense under sections 3 and 9 of the Income Tax Act. The bulletin goes on to state that business related barter transactions are required to be included in the income of the taxpayer based on the price of which the taxpayer would normally have charged a third party. Where the goods or services given up cannot be readily valued, but the goods or services received can, CRA will normally accept the value of the goods or services received.

With token sales, it is unlikely the token will have an established value given the absence of prior sales of the token. As a result, we would expect CRA to look at the value of consideration received in exchange for the token which would be the value of the cryptocurrency at the date of receipt/issuance.

When preparing for your ICO you should work with your tax advisors, it is important to determine whether the token sold via an ICO would be deemed income (e.g. utility token) or capital transaction (e.g. security token), for tax purposes.

Finally, if income tax is applicable, the proceeds from the ICO can be included as revenue and would increase taxable income leading to income tax owing in the tax reporting period. In Ontario, the combined tax rate applicable to taxable income in excess of $500,000 is 26.5%. Any tax paid applicable to a fiscal year can be recovered from losses in future years. Our expectation is that many ICOs will be funding future expenses and, as a result, these companies are likely to report tax losses in future years. The tax losses can be carried back three years to recover previous tax paid.

When planning an ICO where the proceeds will be taxable, you should forecast out the spending to determine if the future losses will result in the recovered of the income tax over a three year period. Further, completing the ICO at the beginning of a tax year will allow for expenses incurred in the year to offset the ICO revenue.

Commodity Tax

There is no similar barter transaction bulletin when determining if GST/HST (QST in Quebec) is applicable to an ICO. As a result, as in the case of income tax, it will be important to clearly define the attributes of the token being sold and work with your tax advisor to determine if GST/HST should be remitted. GST/HST is applicable to sale of goods and services in Canada. GST/HST does not apply to “money” and does not apply to the transfer of a “financial instrument”.

As mentioned, CRA does not view cryptocurrencies as either money or a financial instrument. As result, if the supply of the cryptocurrencies is made in Canada, then they will likely be subject to GST/HST. The ETA contains rules to help determine if a supply is “made in Canada” or “made outside of Canada”. The rules are different for real property, tangible personal property, intangible personal property, and services. CRA has not provided any guidance as to how to classify cryptocurrencies. There are strong indications, however, that cryptocurrency might meet the definition of an intangible personal property.

Intangible personal property is not subject to GST/HST if it cannot be used in Canada. If there are no restrictions placed on the location in which the cryptocurrency can be used, then the sale or barter of cryptocurrency would be deemed to be a supply made within Canada. There are provisions that may effectively “zero-rate” a supply made to a non-resident of Canada who is not registered for GST/HST. You will need to be able to identify the acquirer of the token to verify if they are a resident of Canada or not and whether they are registered for GST/HST. If the token is sold to a Canadian resident and if the sale is deemed to be a taxable supply, the applicable GST/HST rate of the province of the acquirer of the token will need to be remitted to CRA. The remitted amount is not recoverable and would reflect a net cost of the ICO.

The ETA applies GST/HST to all types of taxable transactions including barter transactions. It is possible that the exchange of one cryptocurrency for another might mean that you are required to collect GST/HST on the value of the cryptocurrency you are giving up as well as determine whether you are paying GST/HST on the cryptocurrency you are acquiring in exchange. If the acquisition of a taxable cryptocurrency is for use in your commercial activities (i.e. generating taxable revenues on your sales) then an offsetting input tax credit (ITC) may be available. Given the broad nature of the definition of a taxable supply under the ETA, entrepreneurs planning an ICO should carefully examine the commodity tax rules and conclude if the token offered under the ICO is deemed to be a taxable supply requiring the company to remit GST/HST for sales of tokens consumed in Canada. Hopefully CRA will provide further guidance on this issue in the near future.

Final Thoughts

An ICO is the newest fundraising option that is capturing the attention of entrepreneurs. We expect as technology evolves that we will see further developments around access to capital. Care should be taken to ensure that there is an understanding of the implications fundraising options can have on the business and its current and future stakeholders. An understanding of the tax implications is always an important consideration. As a best practice, properly plan your fundraising efforts and leverage the support of your advisors as part of that planning exercise.

We have addressed the Canadian tax implications which may not be consistent with the tax treatment in other countries. Some entrepreneurs are looking at ICOs in other countries where the tax outcome may be more entrepreneurial friendly. Welch can help assess the tax treatment in foreign markets. The team at Welch LLP has the experience and capability to help. Contact us to discuss.